Whether you’re looking to buy, sell, or refinance a home in Ontario, closing costs are an important consideration. Closing costs can be incurred by both parties and are often necessary for completing the real estate transaction.

What are Closing Costs?

Closing costs refer to those costs directly associated with the act of disposition or acquisition of Real Estate.

There are additional costs associated with purchasing or selling property in Ontario. These should be considered prior to placing an offer. Some costs that aren’t considered “closing costs” for the purposes of this article are:

- Title Insurance

- Land Transfer Tax

- Mortgage Default Insurance

- Appraisal Fees, Inspection fees, WETT Certificate & Others

Closing Costs for Buyers

Buyers of Real Estate in Toronto should factor in costs required to close when looking to purchase property. This is imperative as these costs will be incurred, due at closing, and can affect the amount left to be applied towards down payment.

Legal Fees

In Ontario, every party is required to hire a lawyer to complete conveyance of Real Estate. Buyers and sellers must each “retain” (or hire) their own unique and independent legal counsel.

Buyers who are purchasing property with a mortgage are also responsible for the costs of legal fees associated with application of the mortgage.

Most larger financial institutions allow the Buyer’s lawyer to also perform the duties required to complete and register the mortgage documents. However, some smaller banks, or those completing larger commercial transactions, may require an additional lawyer to represent their interests separate from the Buyer or Seller. The Buyer is usually also responsible for these fees.

Most lawyers charge between $1200 and $2400 for a standard residential purchase. Additional fees may be incurred for complex transactions, those with more than one mortgage, or if a second lawyer for the lender is required.

At Alloway Property Group, legal fees for purchase are included in the transaction at no additional cost to you. Learn more.

Search Fees

A Buyer’s lawyer performs a Title Search on the subject property to check for any issues and encumbrances. The lawyer will then send a requisition letter to the Seller’s Lawyer, asking these deficiencies to be fixed on or before closing.

Land Titles Search

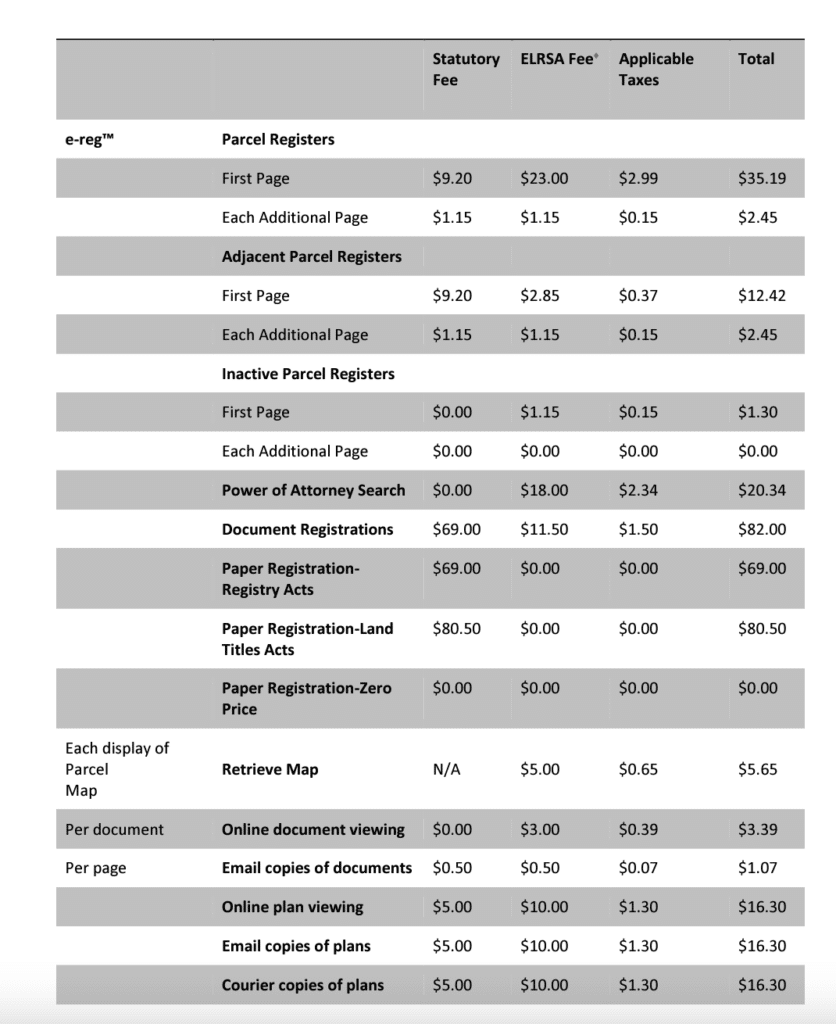

The Title Search requires the Lawyer to search the Land Registry. This process requires fees be paid in exchange for document access. These are referred to as “disbursements”.

Disbursements are charges that lawyers incur on your behalf, and are then charged back to you.

In Ontario, Teranet is responsible for administration of the Land Registrar and sets the rates for document access.

The Typical Title Search for a standard, detached home should be not more than $150.

The scope of the search will vary depending on the Buyer’s decision to purchase Title Insurance.

Writ Search

In addition to searching Title, the Lawyer must perform a search against the owners to ensure there are no Writs of execution registered against them in the region of the property.

In Ontario, Judgments in court can be tied to an owner’s interest in land via a registered Writ of Execution. Any proceeds payable to the Seller could be subject to the Writ, and the funds for sale should then be paid to the court (or as directed) instead of to the Seller directly.

Condominium Act

The Condominium Act dictates that owners are personally liable for the debts of a Condominium Corporation. Ordering a Status Certificate ensures there are no surprises related to the Condominium after closing.

A Status Certificate can show:

- any outstanding fees or assessments payable by the owner

- Pending legal disputes or Judgments affecting the Corp

- Reserve fund balance, known issues, & more.

The Fee for a Status Certificate in Ontario is usually $100. More information on Status Certificates can be found in our Guide to Status Certificates.

Zoning & Building

In addition to legal issues affecting title, Lawyer’s may choose to request clearance certificates from Zoning & Building departments, respectively. These letters confirm that the home conforms to the proper municipal zoning & building code standards.

Zoning Letters & Building letters vary greatly in price – but they typically range in Ontario from $50 per letter to $150 per letter.

Miscellaneous Costs

Buyers should always reserve for miscellaneous costs associated with closing such as postage, courier services, further professional opinions, wire fees, & other matters.

Registration Fees

At closing, Title is transferred from the Seller to the Buyer via registration on Title. There are various closing costs associated with this process, payable to the Land Registrar. The fees typically associated with this are:

- Registration of Deed of Transfer: $82.00

- Registration of Mortgage (per mtg): $82.00

- Municipal Land Transfer Tax Processing Fee: $89.84

Costs for Buyers

A prudent buyer should be prepared to spend upwards of $2,500 in closing costs, to Purchase a home in Ontario.

Closing Costs for Sellers

Selling a home has costs associated. While less work may be required to close the property, the associated

Real Estate Commissions

Real Estate commission fees are typically the largest cost associated with selling a home. These can vary from 4% to 5% total in Ontario. However, it’s important to remember that there is no set or “standard” commission rate in Ontario.

Sellers should discuss with their agents the appropriate commission structure, as well as cooperating commission offered. Commission fees are payable behind taxes & condo fees, but prior to liens or encumbrances. In the event that the mortgage balance exceeds the sale price plus commissions, the Seller would be expected to make up the difference.

Legal Fees

Legal fees to sell a property are typically less than buying, as no arrangement of mortgage and no title search is needed. The Seller’s lawyer responds to requisitions and perfects issues on title before closing. However, a few disbursements would be covered by the Seller on closing, such as:

- Fees for Letters from Judgment holders, confirming the seller is not the same as the individual on the Judgment

- Discharge fees for Mortgage, courier fees, or wire fees for funds are examples of miscellaneous disbursements

Closing Costs: Know Before You Go

Purchasing or Disposing of Real Estate in Ontario can incur various costs when closing. Its important to seek proper estimates prior to entering into binding agreements, in the event a funds shortfall would be found.