How to Buy a Home in Toronto

Buying a Home in Toronto is Hard.

This Guide Makes it Easier.

Buying a home in Toronto can seem like an incredibly daunting task. As likely the single largest transaction you will make in your life, it’s easy to be overwhelmed by the sheer amount of effort required.

Luckily, Catalyst is here to help. We’ve compiled the complete guide to buying a home in Toronto to help those looking to start their journey.

Chapter 1: Laying the Groundwork

“By failing to prepare, you are preparing to fail.” – Ben Franklin

You might be thinking that you’re not ready to buy a home in Toronto just yet. Whether it be lack of funds, an uncertain future, or just general indecision, a home purchase can seem eons away.

While that may be the case, it’s important to lay the groundwork for a home purchase far before you begin the process of a search.

Most clients who buy a home don’t realize just how quickly the mandate to purchase sneaks up on them. By the time they realize they are in need of a home, they feel like they’re caught behind the eight ball, scrambling to catch up.

Laying the foundation for a home purchase can not only prepare you for when the time comes; if done properly, it’ll show you when the time is right.

A. Understanding Purchasing Power

Purchasing Power is a term used to describe the maximum amount a buyer could pay for a property. It is also commonly referred to as “affordability”.

Purchasing power is comprised of two components: capital and leverage.

Capital

Capital is the amount of money readily available for an investment. Capital can either be cash itself, or in highly liquid assets, like stocks, bonds, or funds.

Some buyers may have a significant amount of capital due to their personal financial situation. Inheritances, lottery winnings, or proceeds of sale can all cause someone to have a very large amount of capital to invest.

If a buyer has enough capital, they would theoretically not need any leverage to purchase.

However, with the average price of a home in Toronto over one million dollars, most people don’t have the capital required to purchase a home in Toronto.

Leverage can assist when capital is insufficient.

Even investors with enough capital to buy a property prefer to use leverage to stretch their purchasing power to the max.

Leverage

Leverage is the use of borrowed funds to fund the acquisition of assets.

In simpler terms, it’s borrowing capital from someone else for the purposes of a purchase. In Real Estate, that “someone else” is usually a bank or credit union. The funds are lent via a mortgage.

Prevailing mortgage rates determine your interest rate. This can be affected by personal factors, like credit risk, or external factors, like the overnight rate.

By combining leverage with capital, a buyer can stretch the purchasing power far beyond what one could do on their own.

Buyers should be careful not to over-lever an investment beyond what they can reasonably handle. Consequences could include hitting the trigger rate or an inability to make payments, resulting in Power of Sale or Foreclosure.

There is a limit to the amount you can borrow when looking to buy a home in Toronto. These limits are imposed by the Banks lending you the funds and are based on several factors (more later).

B. Other Costs When Purchasing

There are may more costs associated with buying a home than the price of the property itself. In addition to the purchase price, buyers need to budget enough for the expenses around purchasing a property. These can include:

- Land Transfer Tax

- Closing costs

- Mortgage fees & Default Insurance

- Title Insurance

Land Transfer Tax

Land transfer tax is a fee payable to the government when a property is transferred (bought). It is calculated based on the

Land Transfer tax is a bracketed calculation. This means that the rate changes depending on the amount paid for the property.

Some cities, like Toronto, charge additional LTT, known as Municipal Land Transfer Tax.

All Land Transfer Tax is collected and payable at the time of closing.

In Toronto, first time home buyers can get a Rebate of Land Transfer Tax of up to $8,475.

Ontario Land Transfer Tax Rate

| Purchase Price | Tax Rate |

| Up to $55,000 | 0.5% |

| $55,000.01-$250,000 | 1% |

| $250,000.01 – $400,000 | 1.5% |

| $400,000.01 – $2,000,000 | 2% |

| Over $2,000,000 and more than 2 Single Family Units | 2% |

Closing Costs

In Ontario, everyone who wishes to buy or sell property must hire a lawyer licensed by the Law Society of Ontario to complete the transaction. The Lawyer ensures that the property is transacted in accordance with various laws.

The legal fees associated with closing a typical home purchase are usually between $1,800 and $2,200.

At Catalyst, legal fees are included in the transaction and paid for by the commission.

In addition to the Lawyer’s fees, extra charges may be incurred by the Lawyer on your behalf. These are referred to as disbursements.

Typical disbursements when buying a home can include:

- Title Searches to confirm ownership and the existence of encumbrances or easements

- Purchase of a Status Certificate for condos

- Clearance Letters from Building Departments, Fire Retrofit Certificates, & Zoning Letters from the planning department

- Writ Certificates

Mortgage Fees & Default Insurance

Mortgage Brokers and Financial institutions will often charge fees for arranging the mortgage. These fees are often deducted from the amount advanced to you. It is important to account for these when looking to purchase with leverage.

Typical Mortgage broker fees are 1-3 per cent for a residential purchase.

In addition, loans for a purchase where a buyer gives less than 20% down are required to purchase mortgage default insurance. This insurance protects the bank in the event that the borrower is unable to make payments and the mortgage is not fully recovered.

Mortgage default insurance is deducted from the loan advance, and costs between 2.8% and 4% of the loan amount.

Between broker fees and mortgage insurance, it is recommended to plan for five per cent to be deducted (5%) from the amount borrowed.

| Loan To Value | Premium on Total Loan |

| Up to and including 65% | 0.60% |

| 65.01% to 75% | 1.70% |

| 75.01% to 80% | 2.40% |

| 80.01% to 85% | 2.80% |

| 85.01% to 90% | 3.10% |

| 90.01% to 95% | 4.00% |

C. Factors Affecting Mortgage

Different lending institutions will limit the amount you can borrow to purchase a home. These will be based on a number of factors, including:

- Loan-To-Value of the Appraised Value of the Home

- Debt Service: your ability to make payments as a percentage of your income (ALL housing-related payments, including Property Tax)

- Credit risk history & other factors

When looking to buy a home, don’t automatically assume you’ll only need the minimum 5% down. Some may require up to 35%, depending on those factors.

It’s also important to factor in the appraised value of a home. Lenders issue loans based on the **lesser of** the appraised value or purchase price. If you overpay for a home and it does not appraise for that amount, then you could be left footing the bill for the difference.

D. First Time Home Buyer Incentives

1. RRSP Home Buyer’s Plan

The RRSP Home Buyers Plan allows a first time home buyer to withdraw up to $35,000 tax free from their Registered Retirement Savings Plan (RRSP), for the purposes of purchasing a “qualifying home”, repayable back into the RRSP over 15 years.

2. CMHC Eco Plus Program

The CMHC Eco Plus program helps make energy efficient and low carbon housing choices more affordable to Canadians. Residents can get 25% of their mortgage loan insurance premium back with an energy efficient home.

3. Home Buyer’s Amount Tax Credit

First Time Home Buyers can claim up to $5,000 on their income tax return in the year they purchased their first home. Users must be eligible residents of canada and purchase a home for occupation.

4. Ontario Land Transfer Tax Rebate

The Ontario Government provides a rebate of Land Transfer Tax for First Time Home Buyers up to the first $4,000. In Toronto, the municipal Land Transfer Tax is also rebated up to the first $4,000.

5. First Time Home Buyer Incentive Program

The First-Time Home Buyer Incentive is a shared-equity mortgage with the Government of Canada, which offers:

- 5% or 10% for a first-time buyer’s purchase of a newly constructed home

- 5% for a first-time buyer’s purchase of a resale (existing) home

- 5% for a first-time buyer’s purchase of a new or resale mobile/manufactured home

E. Wrapping it Up: Your Pre-Buyer’s Checklist

Looking to estimate the cost of a home? Download our FREE home purchase cost estimate worksheet & know the actual cost behind buying a property. (Coming Soon)

Chapter 2: Determining Where & What To Buy

“It is discouraging to try to be a good neighbor in a bad neighborhood.”

– William Castle

When you first get access to search the MLS, you’ll realize the unbelievable amount of variety in product available. Between asset class (house, townhome, condo, etc) and geographic location, it can seem like the combinations are, in essence, endless.

However, its important not to let the amount of choice overwhelm the process. Determining what type of property to purchase falls into two general categories: Location & Asset Type.

Location

A saying you hear ad-nauseum is “Location, Location, Location!”. You can remodel, redecorate, and (sometimes) rebuild a home; you can NEVER change where its located.

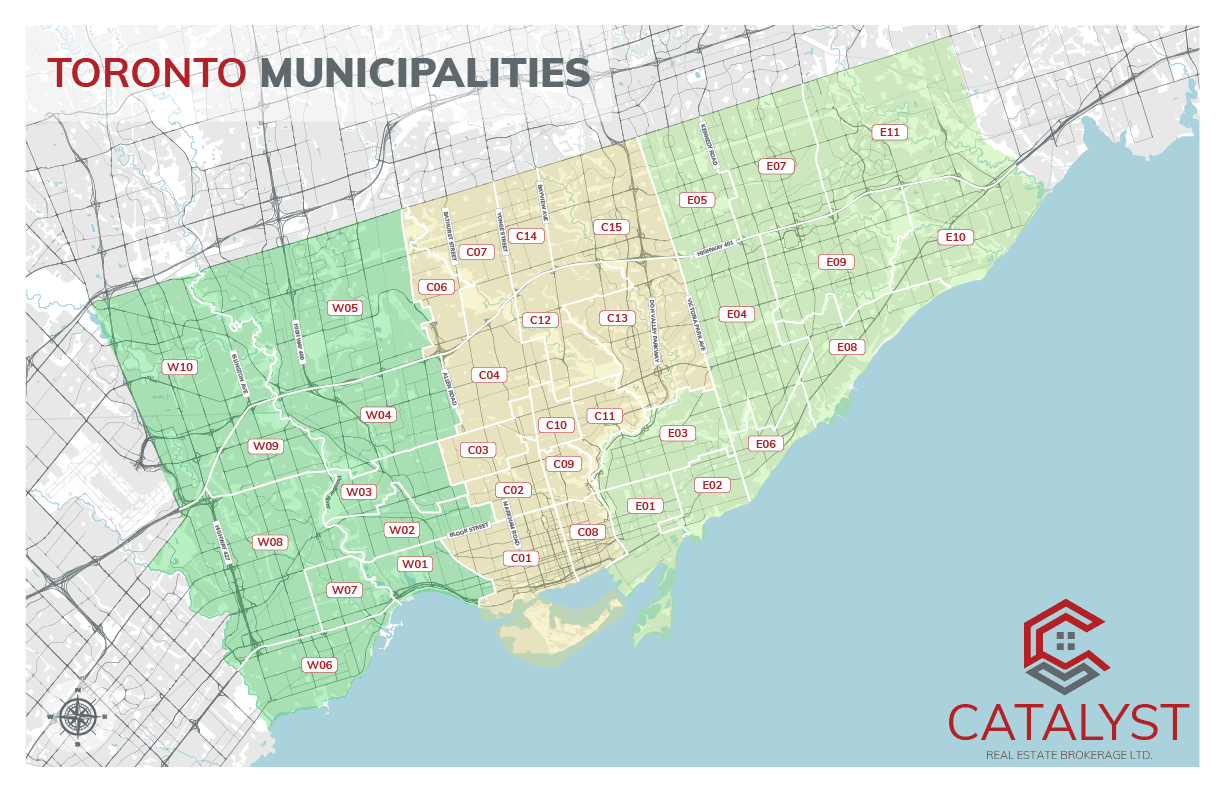

Toronto’s MLS has separated neighbourhoods into Municipalities and Communities. Municipalities are general areas, typically separated by Geographic Boundaries, and Communities are much more granular parts of the Municipality.

When a property is listed, it is ALWAYS sorted by Municipality and Community. Browsing by these characteristics is a great way to stay organized.

Use TRREB’s Community Map Layers tool to experiment and browse for the ideal neighbourhoods in your search.

There are four factors to consider when determining your ideal location.

1. Neighbourhood Demographics

Environ Analytic’s PRIZM lookup allows you to get demographic and lifestyle information of any postal code in Canada!

No one wants to arrive home just to feel like a fish out of water. Analyzing and understanding the demographics of a neighbourhood is critical when assessing location.

Some questions to ask are:

- What is the average age of homeowners in this area?

- Is this neighbourhood dominated by a certain ethnicity or cultural group?

- What is the tenure of the average owner? Is this a transient neighbourhood or are people here for life?

These basic outline questions will start the appropriate conversations

Looking for neighbourhood and demographic information? Perform a PRIZM Lookup using the neighbourhoods postal code.

2. School District

Many homebuyers are looking to take the next step – which often includes starting a family. Ensuring your property is within the right School District is of paramount importance.

While the Toronto District School Board cannot guarantee enrolment in the district, homeowners and residents get sent to the top of the list.

It’s important to analyze the TDSB district search and use our handy TDSB District Map when looking for homes in a specific neighbourhood.

3. Transit, Amenities, Etc.

How close is the home or neighbourhood to public transit? If you use a car to commute, how far is it from the major throughways? What’s the traffic like?

Understanding a neighbourhood’s friendliness to lifestyle should be top of mind when looking for a place to live.

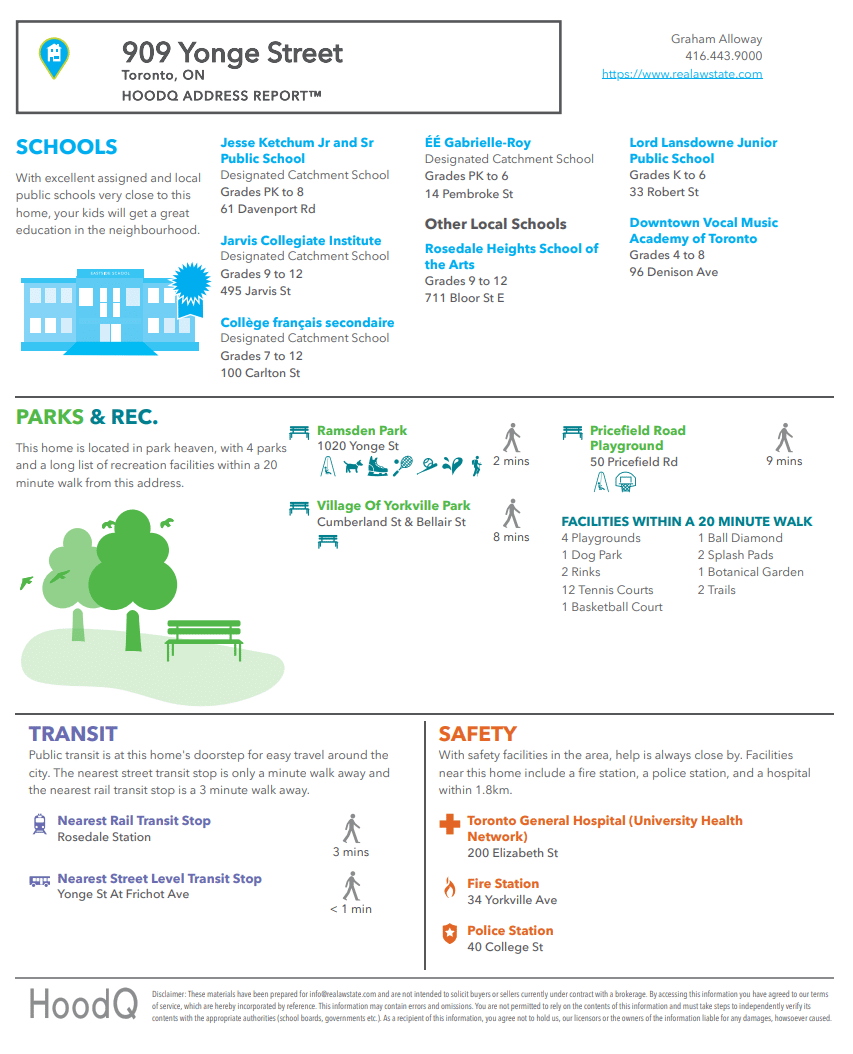

Historically, this was done via taking a look at the Walk Score. Nowadays, the best way to get a quick glimpse of all factors affecting a property is via HoodQ report.

HoodQ reports, like the one above, give a quick 1-page summary of all the amenities, safety facilities, and transit infrastructure nearby. Understanding a property’s proximity to what matters can help you make the right decision when looking to buy.

4. Neighbourhood Plans

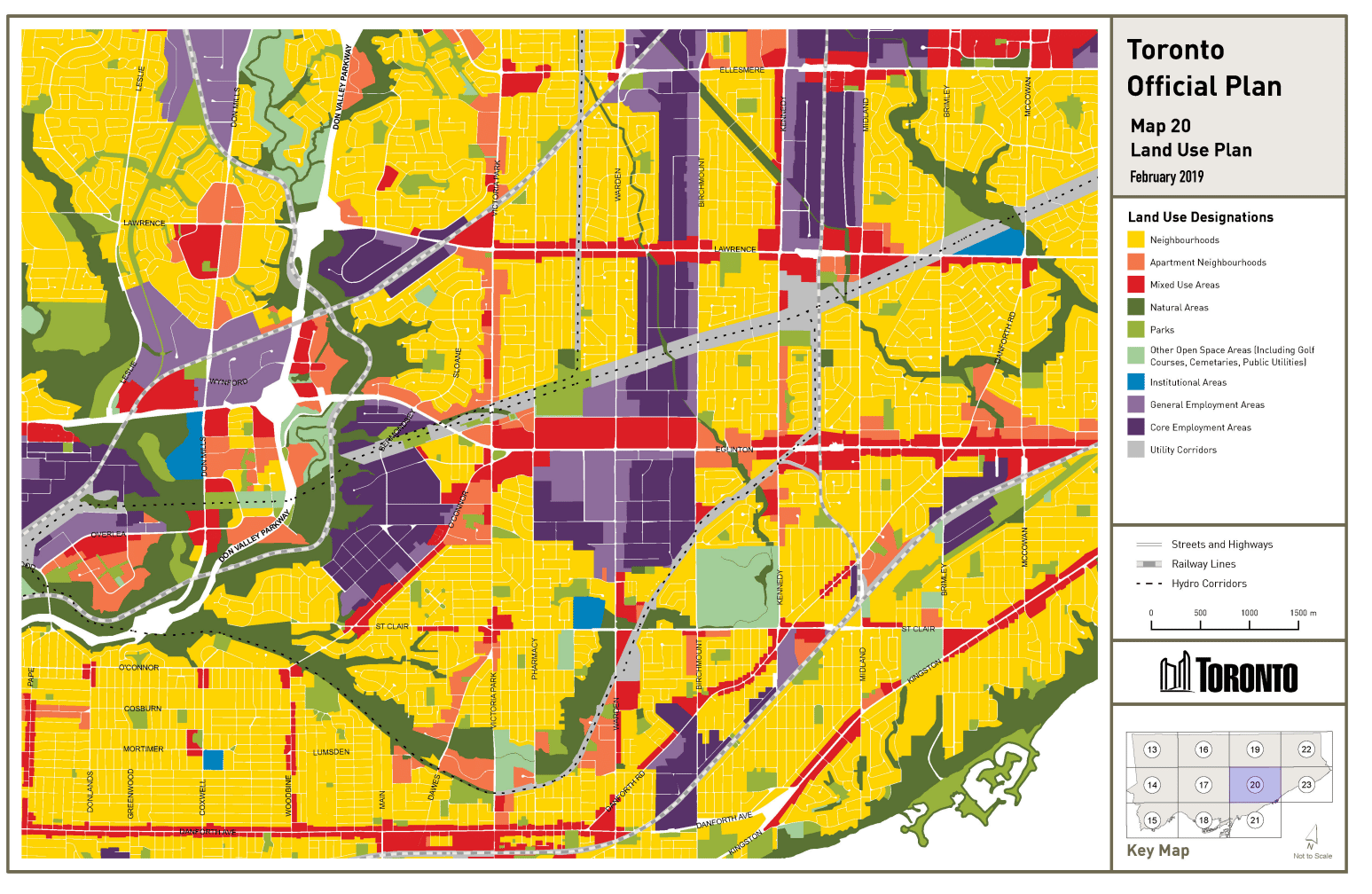

Ontario’s Planning Act mandates that every five years the City of Toronto is required to review and update its Official Plan.

The Official Plan dictates the path of growth for the city. Any neighbourhoods that the municipality is focusing on growth or preservation will be clearly indicated on this plan.

The Official Plan is the document used to dictate zoning by laws and determination of property use.

Why does this matter to a buyer? The simple explanation is that the Official plan will indicate what a neighbourhood may look like in the next 5 years.

Most home owners don’t want to be surrounded by construction sites and condo developments, and moving into a neighbourhood right before breaking ground might lead to some buyer’s remorse.

Review of Toronto’s Land Use Designation Maps and referencing the appropriate chapters in The Official Plan will ensure you’re not buying into a neighbourhood about to be redeveloped.

The Official Plan may dictate the direction for a neighbourhood, but it won’t show projects already undertaken in the area. A quick review of Toronto’s Application Information Centre (AIC) can show all current Committe of Adjustment, Zoning By-Law, and other planning-related applications, as well as the city contact person responsible for each.

Property Type

Property type is less important than location when starting your home search. It won’t take long to realize that homes come in all sorts of shapes and sizes. Understanding what works for you and your objectives will help immensely.

1. Freehold Home

A freehold home is a piece of property with ownership rights. The home is the structure that is built on it. This can be in the form of a Detached, Semi-Detached, Townhome, or Multiplex.

The differences here are illustrated below.

Detached

A detached home has no other properties attached to it.

Semi-Detached

The home is completely on the owner’s freehold land, but joined to another home on one side on a different piece of land via a “party wall”.

Townhome

A Townhome is a freehold piece of property where the home is joined on 2 sides to two other homes.

Multiplex

Two or more dwelling units on one propety and one piece of freehold land.

2. Condominium

A “condominium” refers to a style of ownership where a unit carries with it interest in a condo corporation. The corporation can own the common, or shared elements used by all unit owners.

Owners of condominiums enjoy certain liberties, like shared maintenance, expenses, and upkeep. In exchange for a monthly common expense fee (or “condo fee”), owners can enjoy hands off ownership.

Unit owners are personally liable for the debts of the corporation, so proper review of the Status Certificate is highly encouraged.

Condominiums can be standard apartment style, but they can also exist as townhomes and even detached.

At times, the Condominium Corporation can have no units associated with it whatsoever. This is a “common elements condominium”. Owners of certain freehold pieces of property will carry a share of the CEC, like a golf course or park. This is referred to as a Parcel of Tied Land (POTL).

Chapter 3: Starting the Search

“I’m a great believer in Luck, and I find the harder I work, the more I have of it.”

– Thomas Jefferson

Choosing Your Agent

In Ontario, there’s a difference between an Agent, a REALTOR, and a Broker.

An agent is formally referred to as a salesperson, or sales representative. Agents work for a brokerage and represent the brokerage in negotiations.

Contractually, all agreements buyers and sellers have with “agents” are actually with the brokerage.

A Broker, however, is someone who has completed additional training. These individuals have the ability to run offices and brokerages. Every Brokerage must appoint a Broker of Record to be the designated party responsible for regulatory compliance.

Choosing a Salesperson does not necessarily mean you are choosing someone with less experience. Many successful individuals go their entire career as salespeople, leaving the compliance and regulatory matters to the brokers at the brokerage.

A REALTOR is a term trademarked by the National Association of Realtors. REALTORs are a member of this association or its Canadian equivalent, CREA.

All Agents & Brokers that are a member of CREA can be described as “realtors”. Read more about Agents vs Brokers on our post.

When looking for your first home, it’s important to find someone that is skilled, knowledgeable, and capable of assisting you in your transaction.

Not every agent may be as well versed in the area or property type you are looking to purchase. Others still may have special designations for new construction, contract negotiation, or even dealing with demographics like seniors.

Some questions you can ask your agent are:

- How long have you been practicing Real Estate?

- What is your primary area of practice?

- What neighbourhoods are you familiar with?

- What is your schedule and availability like for showings?

- What value can I expect from your expertise?

Remember, when you enter into a Buyer’s Representation Agreement, you are contracting with the Brokerage. Accordingly, it’s important to ask additional questions about the brokerage the agent belongs to. Some good questions to ask the brokerage are:

- How many agents are actively trading in Real Estate?

- What benefits or perks will I get from working with your Brokerage?

- What is your total deal volume? Do you have a primary asset class that stands out?

- What are my obligations as it relates to a deal? Do I have to sign paperwork that doesn’t allow me to opt out of a purchase?

Often, brokerages will attempt to lure clients & customers with offers of cash back for buyers & low commissions for sellers.

Alternatively, some brokerages seek to add value for services provided with commissions already payable.

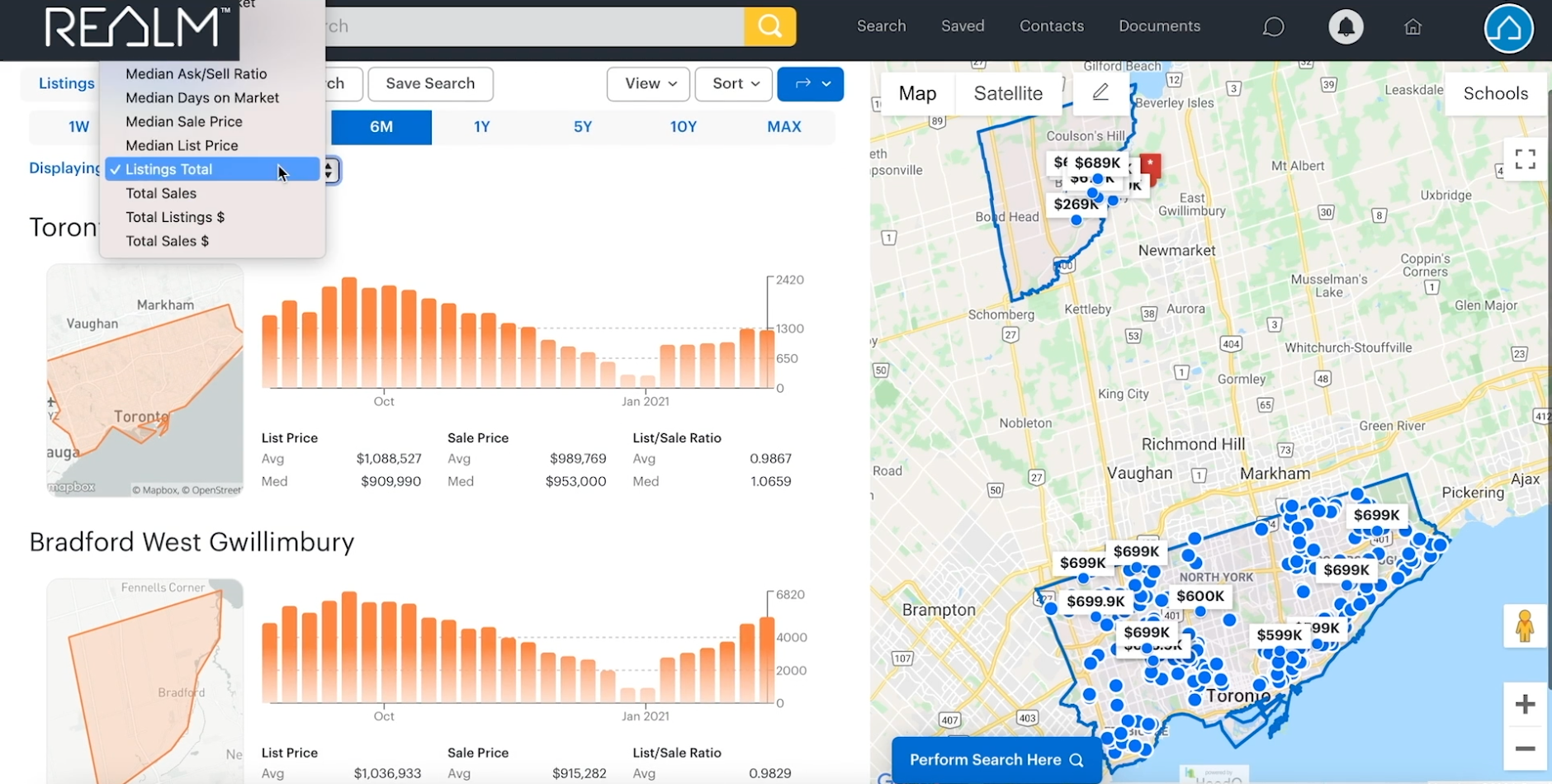

Get Set Up on a Search

Ask your REALTOR to set you up on REALM, or Matrix. Both these systems offer unrestricted access to the Real Estate Board’s data, including available properties and sold listings.

From there, you’ll want to work with your Agent to set up proper search parameters. Give a few neighbourhoods that work for you. Feel free to look at all property types.

These searches will deliver daily results to your email inbox for your review.

Pro-tip: Your search should be specific enough to yield between 50 and 200 results. This will not only ensure that you are not missing out on daily updates by being too granular in the search for your ideal property, but it will also keep the daily updates to a minimum.

Here are the BEST parameters to experiment with searching. Make sure to play around with different combinations.

- Community & neighbourhood

- Property type & style (condo, freehold, townhome, detached, etc)

- Bedrooms & bathrooms (including full and half baths)

- Basement finish

- Parking

- Exposure – which way does the unit face? (good for narrowing condos)

Attend Showings

Once you’ve found a property that fits your goals, it’s time to visit!

At your showings, make sure to take a good look at the property, while still respecting the owner’s space. First, look for benefits and features about the property. MLS listings have limits, and all the perks of ownership may not have been disclosed!

Next, look for obvious signs that the owner may be hiding issues or drawbacks. A critical eye now can save you thousands of dollars down the line.

Your REALTOR will be able to assist you in looking for important aspects of a home.

Showings are useful to see if a property measures up to its photos. Sometimes, it can be difficult to picture and visualize a space prior to visiting. After a few showings, you’ll likely be able to know if a future property is worth seeing just from its pictures!

Chapter 4: The Offer Process

“Everything is negotiable. Whether or not the negotiation is easy is another thing.”

– Carrie Fisher

Making an Offer

About the Offer

Once you’ve found the ideal property, it’s important to understand the offer.

All offers have three main components:

- Description of the property being purchased (including what’s included and what’s not)

- Consideration (i.e. purchase price) & deposit

- Terms (closing date, conditions, etc)

Your REALTOR and your Lawyer will be able to assist you with proper drafting of an offer. As the most critical step in negotiation, attention to detail is paramount.

Conditions

It is always recommended that every offer be accompanied by conditions. A condition is a clause that allows the deal to be terminated should a material fact become discovered. There are three conditions that are recommended for every offer:

- The Buyer’s arranging of adequate financing, including appraisal of the property

- Confirmation of zoning and confirming that the property conforms to by-laws

- The Buyer’s ordering and review of an inspection report, acquiring a WETT Certificate, or confirming the presence or absence of harmful materials, like asbestos.

- Lawyer’s Review of the Status Certificate in condo properties.

All conditions need to have a date by which they will be met.

Conditions can be grouped into two categories: Condition Precedent and Condition Subsequent

Condition Precedent: The party must notify the condition is fulfilled, otherwise it is not.

Condition Subsequent: A condition is deemed to have been fulfilled unless notified otherwise.

Read more About Condition Precedents and Subsequents on our blog.

Negotiation

Upon receipt of the offer, the Seller will typically review and provide comments or feedback. Once a clear picture of the offer is understood, the Seller has three choices:

- Reject the offer outright

- Accept the offer

- Counter-offer with different terms or price

Should the Seller decide to counter-offer, the Buyer then is faced with the same three choices. The process repeats until a binding agreement is reached.

Upon acceptance of the agreement, deposit is typically due.

In Toronto Real Estate, its recommended to begin with your “best foot forward”; never assume a second “crack at the can”.

Bidding Wars and “Sellers Markets”

In hot Real Estate markets, Sellers may choose to expose the home to the market for a period of time prior to accepting offers. This can lead to Multiple Offer Situations.

In Multiple Offers, those looking to buy a Toronto home are forced to compete with one another, presenting all offers at the same time and having the best or strongest chosen.

In these situations, it can be harder to justify conditional periods. Some Sellers will do appraisals or home inspections in an attempt to have firm offers (those with no conditions) presented.

However, do not let this dissuade you from submitting offers with conditions. All offers have an equal right to be presented, and Sellers can choose offers with higher consideration even if they come with conditions.

In some situations, a Buyer can present a Bully Offer prior to the offer submission date. A Bully offer creates a Situation in which the Seller must accept, counter, or decline the offer before receiving the other offers.

Once a firm, binding agreement is formed and all conditions are removed, the Lawyer will begin to prepare for closing.

Lawyers will complete documents necessary to request the mortgage funds from the bank and satisfy them of any outstanding conditions.

A Lawyer in Ontario can request certain stipulations of the seller be met by sending a letter prior to the Requisition Date. Lawyers must be satisfied that free and clear title can be granted to the purchaser.

Issues that could affect title and must be dealt with prior to closing can include:

- Easements, rights of way, or other encroachments

- Condo liens due to unpaid common expenses

- Issues running to the root of title, including:

- Fraud

- Violation of The Planning Act

- Inconsistent or illegal use with Zoning By Laws

- Unsettled acts of Expropriation

The Signing Meeting & Closing

At your signing meeting, the lawyer will review everything discovered about the property and have you execute the necessary documentation to satisfy the bank & close the property.

Congratulations!

You’re a home owner now!